Who it's for

Flow is for wealth management teams, CIOs, portfolio strategists, and client advisors who need to explain risk, compare allocations, and make choices with confidence—without another 80-page deck.

Why Flow instead of another PowerPoint

PowerPoint forces you to over-summarize. Slides appear and disappear, so the brain can't form spatial connections and the story fades as soon as the meeting ends.

Flow presents the same portfolio as a sequence of spatial steps, so relationships persist in view and stick in memory.

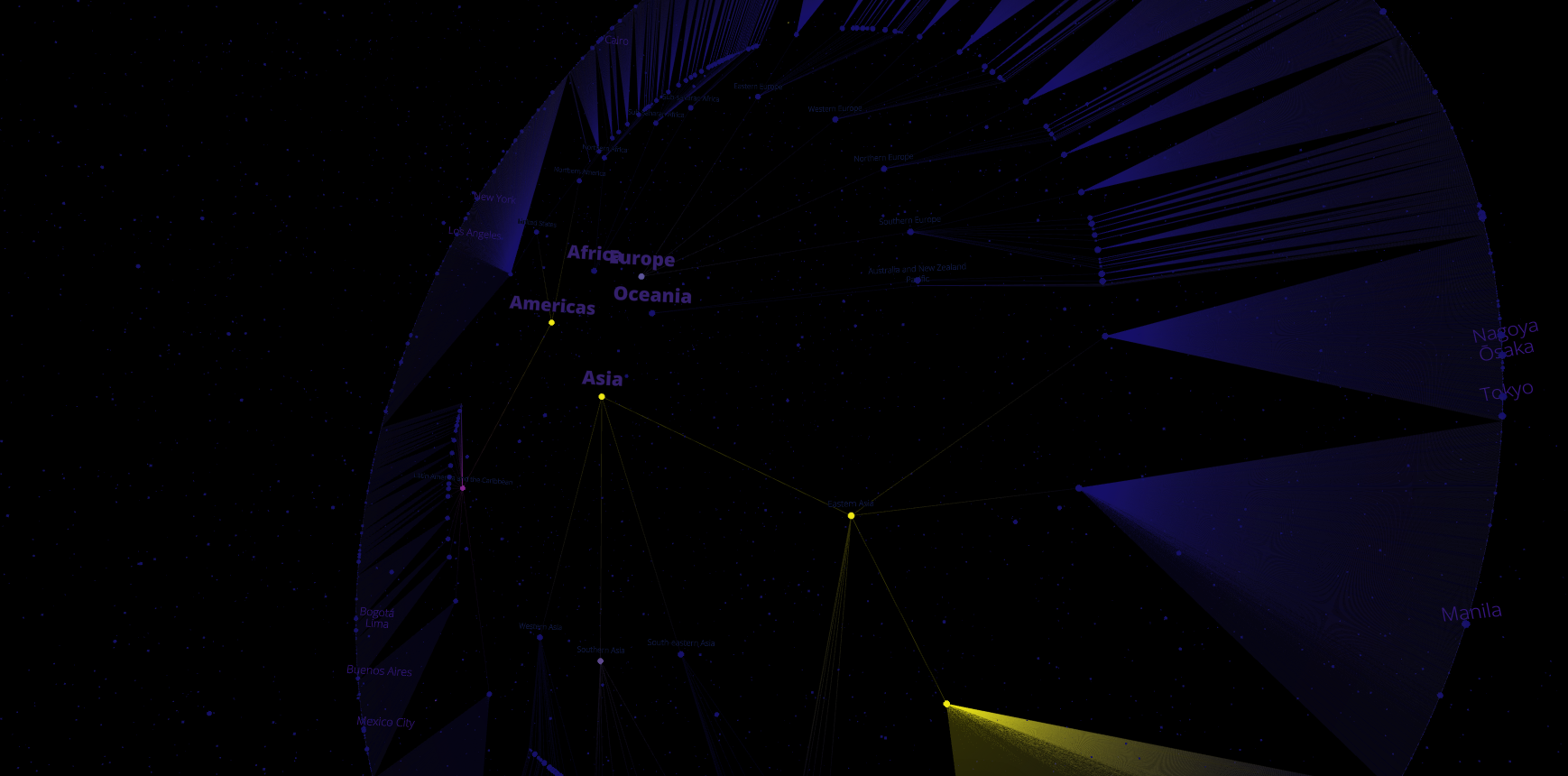

With 3D, you can show more detail in the same space—down to every transaction or position—without visual crowding or credibility loss. You can rotate, filter, and drill in front of the room, instead of hiding nuance in "backup" slides.

And because it's interactive and multiuser, clients don't passively watch; they point, ask, and remember.

What you can do in a Stock Portfolio Flow

Expose concentration and factor risk

Map exposure, return, and volatility to three axes; keep positions visible while stepping from 'yearly' to 'daily' views.

See relationships that matter

Sector, region, style, liquidity—without collapsing them into one number. 3D reduces overlap and reveals structure.

Bring the analysis to the room

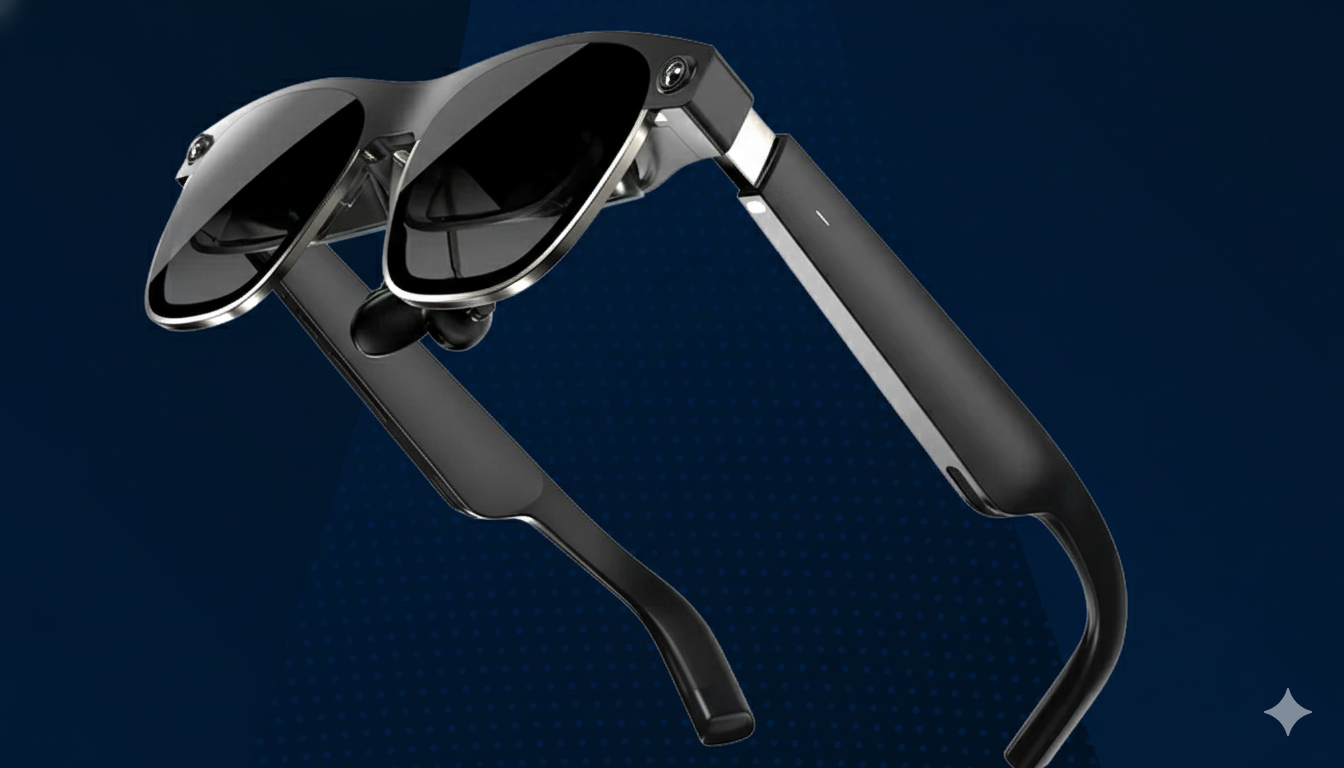

Still present with your client. Everyone sees the same model floating over the table, with laser pointers and simple controls—on laptops, phones, or smart glasses.

Track the details that change outcomes

It's obvious when 'the last week saved the quarter' or when a handful of trades drive performance.

AI that surfaces what matters

Flow's AI lets you ask portfolio questions in plain language—"show largest drawdowns," "compare dividend yield vs. duration," "highlight illiquid outliers"—and then shows the answer as an interactive visual, not a paragraph.

AI helps non-experts manipulate datasets while experts move faster.

For financial services and wealth management, that means anomaly detection, side-by-side scenario comparisons, and faster client conversations that stay grounded in the actual positions.

Better client engagement means trust

Clients trust you if they are more engaged by an experience, not a lecture. They can see themselves in the data, selecting options and asking the AI for insights.

Spatial presentations activate the brain's memory systems; people retain more and align faster when they can stand around the same model and explore together.

This is why Flow sessions are remembered long after typical slide reviews are forgotten.

Recommended hardware: XREAL smart glasses

XREAL smart glasses are comfortable and convenient—ideal for conference-table portfolio reviews.

They're already being used to demo Flow on the show floor and in business meetings; the glasses form factor feels natural and is ready for production use cases where you want people present with each other and the data.

Typical wealth-management use cases

Quarterly Portfolio Reviews

Show risk drivers instead of narrating them

Client Education

Compare 'what happened' vs. 'what if' in a single scene

Board/IC Briefings

Replace decks with a step-by-step spatial story

The takeaway

PowerPoints are quickly forgotten. A Flow with a few well-designed steps gives the brain a single, durable model of the portfolio—so clients see the relationships, the risks, and the decisions you recommend.

3D makes the structure clear. AI surfaces outliers and comparisons. People engage because they're part of the analysis, not just the audience.

Flow — where teams and data meet eye-to-eye.